True North Commercial REIT Reports Q4 2020 and Year End Results

High quality government and credit rated tenant base results in 99% contractual rent collection, NOI growth of 21% and strong occupancy of 98%

545,600 sq ft leased/renewed with a WALT of 7.8 years during 2020

/NOT FOR DISTRIBUTION IN THE U.S. OR OVER U.S. NEWSWIRES/

TORONTO, ON – March 3, 2021 – True North Commercial Real Estate Investment Trust (TSX: TNT.UN) (the “REIT”) today announced its financial results and provides a COVID-19 update for the three months and year ended December 31, 2020.

“The fourth quarter brought 2020 to a successful conclusion with continued strong rent collections and positive operating results despite the COVID-19 pandemic” stated Daniel Drimmer, the REIT’s President and Chief Executive Officer. “Contractual rent collection of 99%, increased liquidity, positive leasing spreads and high tenant retention has positioned the REIT to effectively navigate through these times of uncertainty.”

Q4 Highlights

- Collected approximately 99% of contractual rent in Q4 2020

- Contractually leased and renewed approximately 60,300 square feet with an average increase of approximately 8.3% over expiring rates, including 32,500 square feet with the Federal Government of Canada

- Portfolio occupancy of 98% with an average remaining lease term of 4.7 years

- On December 11, 2020, the REIT entered into a new $60 million floating rate revolving credit facility for a two-year term maturing on December 1, 2022 resulting in up to $85 million in cash and undrawn credit facilities at the end of Q4 2020

- Revenue and NOI increased 23% and 21%, respectively compared to Q4 2019. The majority of which can be attributed to acquisitions totaling $395.8 million in Q4 2019, offset by Same Property NOI decrease of 2.3%

- Same Property NOI experienced an overall decline of 2.3%, the majority of which can be attributed to the REIT's only asset in Edmonton, Alberta and lower parking revenue due to reduced foot traffic at certain properties due to COVID-19. Excluding the above, Same Property NOI increased 2.7% for the quarter

- FFO per Unit and AFFO per Unit on both a basic and diluted basis increased $0.01 compared to Q4 2019 to $0.15 and $0.14, respectively

YTD Highlights

- Collected approximately 99% of contractual rent during 2020

- Contractually leased and renewed approximately 545,600 square feet with a weighted average lease term of 7.8 years and an average increase of approximately 6.4% over expiring rates. 368,000 square feet of 2020 leasing activity was with Federal government tenants

- Revenue and NOI increased 31% and 35%, respectively compared to YTD 2019.

- Same Property NOI decreased by 1.9%. A reduction in parking revenue due to lower utilization at certain properties, rent concessions associated with the Canada Emergency Commercial Rent Assistance (“CECRA”) program, lower one-time termination payments and project management fees along with vacancy and lower rental rates in the REIT's Edmonton, Alberta property were the main contributors to the decline in Same Property NOI. Excluding the impact of the above, Same Property NOI increased 2.4% for 2020

- FFO per Unit on both a basic and diluted basis increased $0.02 compared to YTD 2019 to $0.60 and $0.59, respectively

- AFFO basic per Unit remained stable at $0.57 and AFFO diluted per Unit increased $0.01 to $0.57

COVID-19

- Since the beginning of the pandemic, the REIT has received approximately 99% of its 2020 contractual rent, a trend which continues in the first two months of 2021 and is a direct result of its credit and government tenant roster.

- A total of 19 tenants (46,000 square feet) participated in the CECRA program which came to an end on September 30, 2020. The REIT's 25% rental contribution resulted in a $0.19 million expense recognized in property operating costs in 2020.

- On October 9, 2020, the Federal Government announced a new Canada Emergency Rent Subsidy program (“CERS”) to assist businesses experiencing a significant drop in revenue as a result of the COVID-19 pandemic. Currently 5 tenants have applied to CERS and the REIT recognized a $0.02 million expense in property operating costs representing a 35% rental provision granted to tenants in Q4 2020.

- The REIT agreed to defer approximately $0.44 million of YTD 2020 rental payments for certain tenants. As of March 3, 2021, $0.42 million of rent deferrals have been received in accordance with those deferral agreements.

While vaccination programs have begun to be implemented throughout Canada, industries, including retail and commercial real estate, continue to be affected in varying degrees by COVD-19. It continues to be difficult to predict the duration and extent of the impact of COVID-19 on the REIT’s business and operations, both in the short and long-term. Certain aspects of the REIT’s business and operations that could potentially be impacted include, without limitation, rental income, occupancy, future demand for space and market rents, all of which ultimately impact the underlying valuation of the REIT's investment properties and its ability to maintain its distributions.

With a close to fully occupied portfolio of predominantly government and credit-rated tenants, the REIT is well positioned to maintain stability through these times of uncertainty.

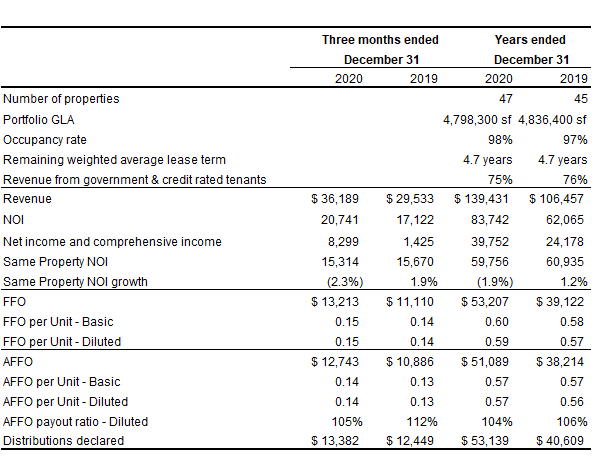

Key Performance Indicators

Operating Results

Towards the end of 2019, the REIT increased its portfolio by approximately 1.1 million square feet through acquisitions totaling $395.8 million, which was the main contributor to increases in revenue and NOI of 23% and 21%, respectively. Q4 2020 occupancy was 98% with an average remaining lease term of 4.7 years. 75% of revenue is generated from government and credit rated tenants.

FFO and AFFO increased 19% and 17%, respectively, when compared to Q4-2019. The favourable increase in operating metrics is attributable to Q4-2019 acquisition activity which was partially offset by lower Same Property NOI and higher finance costs. FFO and AFFO per Unit on both a basic and diluted basis increased $0.01 to $0.15 and $0.14 when compared to Q4 2019.

On September 30, 2020 and November 5, 2020 the REIT completed the sale of 534 Queens Avenue and 197-199 Dundas Street, both located in London, Ontario for a sale price of $2.25 million and $1.4 million, respectively. Together these properties comprised a total of 39,200 square feet. These dispositions are in line with the REIT's strategy to focus on office properties in larger urban markets.

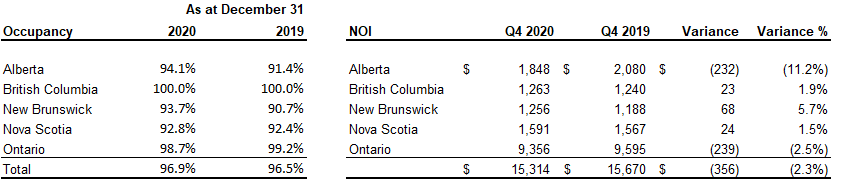

Same Property Results

Q4 2020 Same Property NOI decreased 2.3% and 1.9% YTD 2020.

A reduction in parking revenue due to lower utilization at certain properties, rent concessions associated with the CECRA program, lower one-time termination payments and project management fees along with vacancy and lower rental rates at the REIT's Edmonton property were the main contributors to the decline in Same Property NOI.

The REIT's lone asset in Edmonton continues to account for the majority of the decline in Same Property NOI (Q4 2020 - 1.1% and YTD 2020 - 2.4%). During the third quarter, the REIT was successful in securing a new one-year short term 15,900 square foot lease with the Province of Alberta. Additionally, during the fourth quarter, the REIT secured and commenced a 10 year lease for 7,744 square feet increasing occupancy at this property to 97% at the end of Q4 2020.

Increased revenue from contractual rent step ups have been the main driver of Same Property NOI growth in British Columbia and Nova Scotia. Favourable Same Property NOI in New Brunswick is attributed to new lease deals and expansions resulting in increased occupancy of 93.7%.

Ontario Same Property NOI declined due to a reduction in parking revenue at certain properties due to COVID-19 and downtime associated with a lease expiry the majority of which has been subsequently re-leased at significantly higher market rents with rents commencing in the first half of 2021. This decline was partially offset by new lease deals and an increase in expiring rates on renewals at certain properties.

Excluding the Edmonton property, rent concessions associated with the CECRA and CERS program, lower parking revenue from reduced foot traffic and downtime noted in the Ontario portfolio, Same Property NOI increased 2.7% (YTD 2020 – 2.4%).

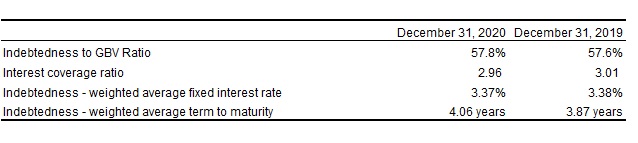

Debt and Liquidity

As at December 31, 2020, Indebtedness to GBV ratio was 57.8%, a level well within the 75% limit set out in the REIT's amended and restated declaration of trust. The weighted average interest rate on the REIT's mortgage portfolio was 3.37%, with a weighted average term to maturity of 4.06 years.

During the year ended December 31, 2020, the REIT refinanced fourteen mortgages totaling $152.7 million with a weighted average fixed interest rate of 3.07% and weighted average term to maturity of 7.6 years providing the REIT with additional liquidity of approximately $42.1 million. The REIT has limited refinancing exposure with only 2.0% of its portfolio maturing from now until the end of 2021.

On December 11, 2020, the REIT entered into a new $60 million floating rate revolving credit facility for a two-year term maturing on December 1, 2022 resulting in up to $85 million in cash and undrawn credit facilities at the end of Q4 2020.

About the REIT

The REIT is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario. The REIT currently owns and operates a portfolio of 47 commercial properties consisting of approximately 4.8 million square feet in urban and select strategic secondary markets across Canada focusing on long term leases with government and credit rated tenants.

The REIT is focused on growing its portfolio principally through acquisitions across Canada and such other jurisdictions where opportunities exist. Additional information concerning the REIT is available at www.sedar.com or the REIT’s website at www.truenorthreit.com.

Non-IFRS measures

Certain terms used in this press release such as funds from operations (“FFO”), adjusted funds from operations (“AFFO”), net operating income (“NOI”), same property net operating income (“Same Property NOI”), indebtedness (“Indebtedness”), gross book value (“GBV”), Indebtedness to GBV ratio, net earnings before interest, tax, depreciation and amortization and fair value gain (loss) on financial instruments and investment properties (“Adjusted EBITDA”), interest coverage ratio, and adjusted cash provided by operating activities are not measures defined by International Financial Reporting Standards (“IFRS”) as prescribed by the International Accounting Standards Board (“IASB”), do not have standardized meanings prescribed by IFRS and should not be compared to or construed as alternatives to profit/loss, cash flow from operating activities or other measures of financial performance calculated in accordance with IFRS. FFO, AFFO, NOI, Same Property NOI, Indebtedness, GBV, Indebtedness to GBV ratio, Adjusted EBITDA, interest coverage ratio and adjusted cash provided by operating activities as computed by the REIT may not be comparable to similar measures presented by other issuers. The REIT uses these measures to better assess the REIT's underlying performance and provides these additional measures so that investors may do the same. Details on non-IFRS measures are set out in the REIT's Management's Discussion and Analysis for the three months and year ended December 31, 2020 (“MD&A”) and the Annual Information Form (“AIF”) are available on the REIT's profile at www.sedar.com.

Forward-looking Statements

Certain statements contained in this press release constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking statements are provided for the purposes of assisting the reader in understanding the REIT’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Forward-looking information may relate to future results, performance, achievements, events, prospects or opportunities for the REIT or the real estate industry and may include statements regarding the financial position, business strategy, budgets, projected costs, capital expenditures, financial results, taxes, plans and objectives of or involving the REIT. In some cases, forward-looking information can be identified by such terms as “may”, “might”, “will”, “could”, “should”, “would”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “seek”, “aim”, “estimate”, “target”, “goal”, “project”, “predict”, “forecast”, “potential”, “continue”, “likely”, or the negative thereof or other similar expressions suggesting future outcomes or events.

Forward-looking statements involve a number of risks and uncertainties, including statements regarding the outlook for the REIT's business and results of operations and the effect of the coronavirus (SARS- CoV-2) ("COVID-19") pandemic on the REIT's business and operations. Forward-looking statements involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond the REIT’s control, affect the operations, performance and results of the REIT and its business, and could cause actual results to differ materially from current expectations of estimated or anticipated events or results. These factors include, but are not limited to, risks and uncertainties related to the trust units of the REIT (“Units”), risks related to the REIT and its business, and any risks related to the uncertainties surrounding the duration and the direct and indirect impact of the COVID-19 pandemic on the business, operations and financial condition of the REIT and its tenants, as well as on consumer behavior and the economy in general, including the ability to enforce leases, perform capital expenditure work, increase rents, raise capital through the issuance of Units or other securities of the REIT and obtain mortgage financing on the REIT's properties. The foregoing is not an exhaustive list of factors that may affect the REIT's forward-looking statements. Other risks and uncertainties not presently known to the REIT could also cause actual results or events to differ materially from those expressed in its forward-looking statements. The reader is cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking statements as there can be no assurance actual results will be consistent with such forward-looking statements.

Information contained in forward-looking statements is based upon certain material assumptions applied in drawing a conclusion or making a forecast or projection, including management’s perception of historical trends, current conditions and expected future developments, as well as other considerations believed to be appropriate in the circumstances. There can be no assurance regarding: (a) the breadth of impact of COVID-19 on the REIT’s business, operations and performance, including the performance of its Units; (b) the REIT’s ability to mitigate any impacts related to COVID-19; (c) credit, market, operational, and liquidity risks generally; (d) Starlight Group Property Holdings Inc., or any of its affiliates (“Starlight”), continuing as asset manager of the REIT in accordance with its current asset management agreement; and (e) other risks inherent to the REIT’s business and/or factors beyond its control which could have a material adverse effect on the REIT.

The forward-looking statements made relate only to events or information as of the date on which the statements are made in this press release. Except as specifically required by applicable Canadian law, the REIT undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

For further information:

Daniel Drimmer

President and Chief Executive Officer

(416) 234-8444

or

Tracy Sherren

Chief Financial Officer

(416) 234-8444