True North Commercial REIT Reports Q1 2021 Results

Strong Contractual Rent Collection of 99.5%, Stable Occupancy of 97% and Positive Operating Results

104,900 sq ft leased/renewed with a WALT of 7.2 years during Q1 2021

/NOT FOR DISTRIBUTION IN THE U.S. OR OVER U.S. NEWSWIRES/

TORONTO, ON – May 5, 2021 – True North Commercial Real Estate Investment Trust (TSX: TNT.UN) (the “REIT”) today announced its financial results and provides a COVID-19 update for the three months ended March 31, 2021.

“Industry leading rent collections of 99.5%, continued stable occupancy and positive operating results has given the REIT a strong start to 2021” stated Daniel Drimmer, the REIT’s President and Chief Executive Officer. “The high credit and government tenant mix of our portfolio has always been key to our strategy which is evidenced by our continued positive operating results and stability through these times of uncertainty".

Q1 Highlights

- Collected approximately 99.5% of contractual rent in Q1 2021.

- Contractually leased and renewed approximately 104,900 square feet with a weighted average lease term of 7.2 years.

- Portfolio occupancy of 97% with an average remaining lease term of 4.7 years.

- Revenue and NOI have slightly declined compared to Q1 2020 due to the sale of two small properties in tertiary markets in Q4 2020, offset by higher Same Property NOI of 0.8%.

- Same Property NOI experienced an overall increase of 0.8%, which can be attributed to increased occupancy at certain properties combined with contractual rent step ups, higher project management fees and one-time termination payments. This increase was partially offset by a reduction in parking revenue due to lower utilization at certain properties and increased vacancy and slightly lower rental rates at the property in downtown Calgary.

- FFO and AFFO per Unit on both a basic and diluted basis remained stable compared to Q1 2020 at $0.15 and $0.14, respectively.

- As at March 31, 2021, the REIT had access to approximately $65,921 of cash and undrawn credit facilities. With a weighted average maturity of 3.81 years for its mortgage portfolio, the REIT also had limited refinancing exposure with only 2.0% of its portfolio maturing in 2021.

Subsequent Events

- On April 12, 2021, the REIT disposed of 529-533 Exmouth Street located in Sarnia, Ontario, a non-core property totaling 15,400 square feet for a sale price of $1.85 million. This disposition is in line with the REIT's strategy to focus on office properties in larger urban markets.

- On May 3, 2021, the REIT entered into an agreement to dispose of 5900 Explorer Drive, Mississauga, Ontario totaling 40,000 square feet for a sale price of approximately $11.9 million. Excluding transaction costs, the REIT is expected to realize a $1.8 million gain on sale over the Q1 2021 fair value. Closing is expected to be on or about May 31, 2021.

COVID-19

- Since the beginning of the pandemic, the REIT has received approximately 99% of its 2020 contractual rent, a trend which has continued in Q1 2021.

- On October 9, 2020, the Federal Government announced the Canada Emergency Rent Subsidy program (“CERS”) to assist businesses experiencing a significant drop in revenue as a result of the COVID-19 pandemic. Currently six tenants are participating in the CERS program and the REIT recognized a $0.03 million expense in property operating costs representing its rental provision granted to tenants for Q1 2021.

- The REIT has deferred a total of $0.44 million of rental payments for certain tenants since the start of the pandemic. Pursuant to the deferral agreements $0.43 million of these rental payments had been received as of March 31, 2021.

While vaccination programs continue to be implemented throughout Canada, industries, including retail and commercial real estate, continue to be affected in varying degrees by COVD-19. All provinces and territories have begun mass vaccination programs to inoculate Canadians against COVID-19; however, the phased-in roll-outs remain fluid as public health authorities continue to make adjustments to their plans due to the timing and volume of shipments from vaccine suppliers to the Federal government and then to each community. Current government forecasts indicate that most Canadians are anticipated to be fully immunized by the end of September 2021, although this forecast is dependent on, among other things, the ability of approved vaccine suppliers to meet quarterly delivery targets.

It continues to be difficult to predict the duration and extent of the impact of COVID-19 on the REIT’s business and operations, both in the short and long-term. Certain aspects of the REIT’s business and operations that could potentially be impacted include, without limitation, rental income, occupancy, future demand for space and market rents, all of which ultimately impact the underlying valuation of the REIT's investment properties and its ability to maintain its distributions.

Officer and Board Appointments

On April 7, 2021, the REIT announced that effective May 17, 2021, Daniel Drimmer will be stepping down as President and Chief Executive Officer of the REIT and Leslie Veiner, the current Chief Financial Officer of Northview Canadian High Yield Residential Fund (TSX: NHF.UN), will commence serving as Chief Executive Officer and join the Board of Trustees of the REIT. Mr. Veiner’s appointment will augment the REIT’s existing senior management team led by Tracy Sherren, the REIT’s current Chief Financial Officer, who has been promoted to serve as President of the REIT in addition to her existing position as Chief Financial Officer and as a Trustee of the REIT. Mr. Drimmer will remain as Chairman of the Board of Trustees.

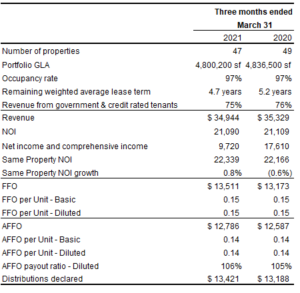

Key Performance Indicators

Operating Results

NOI remained relatively flat compared to Q1 2020 as a result of Same Property NOI growth of 0.8% offset by the dispositions completed at the end of 2020. Q1 2021 occupancy remained stable comparing to same period in 2020 at 97% with an average remaining lease term of 4.7 years.

FFO and AFFO increased 3% and 2%, respectively, when compared to Q1 2020. The increase in FFO and AFFO was a result of higher Same Property NOI and lower finance costs, partially offset by lower NOI from dispositions completed in 2020. FFO and AFFO per Unit on both a basic and diluted basis have remained stable when compared to Q1 2020 at $0.15 and $0.14, respectively.

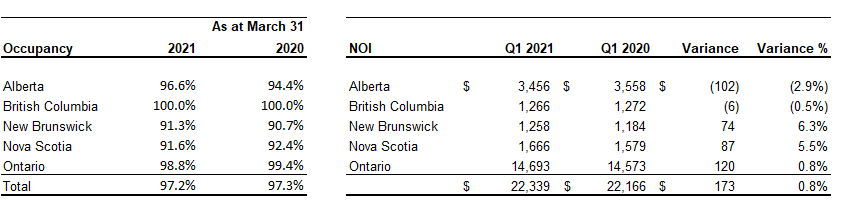

Same Property Results

Q1 2021 Same Property NOI increased 0.8% compared to the same period in 2020.

While occupancy has increased in the REIT’s Alberta portfolio, Same Property NOI has decreased by 2.9% when compared to the same period in 2020. The REIT’s Edmonton property has experienced an increase in occupancy and NOI, while the property in downtown Calgary has been impacted by increased vacancy and slightly lower rental rates.

Favourable Same Property NOI in New Brunswick is mainly attributed to increased occupancy and existing tenant expansions. Nova Scotia continues to be positively impacted by contractual rent step ups while same property occupancy has slightly decreased due to a lease expiry at the end of Q1 2021.

Same Property NOI in Ontario increased 0.8% due to an increase in occupancy in the Ottawa portfolio, higher project management fees and one-time termination payments. This increase was offset by a reduction in parking revenue due to lower utilization at certain properties due to COVID-19. Ontario was also negatively impacted by downtime associated with a 78,000 square foot lease expiry in Q2 and Q3 of 2020, of which 37,000 square feet commenced in Q1 2021 at higher rental rates and 38,000 square feet is set to commence in Q2 2021 and Q4 2021.

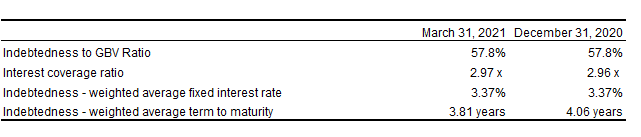

Debt and Liquidity

As at March 31, 2021, Indebtedness to GBV ratio was 57.8%, a level well within the 75% limit set out in the REIT's amended and restated declaration of trust.

At the end of Q1 2021, the REIT had access to approximately $65,921 of cash and undrawn credit facilities. With a weighted average maturity of 3.81 years for its mortgage portfolio, the REIT also had limited refinancing exposure with only 2.0% of its portfolio maturing in 2021.

ATM Program

The REIT has established an at-the-market equity program (the “ATM Program”) that allows the REIT to issue and sell up to $50 million of Units to the public, from time to time, at the REIT's discretion. Units sold under the ATM Program will be sold through the Toronto Stock Exchange or on other marketplaces to the extent permitted at the prevailing market prices at the time of sale. The REIT intends to use the net proceeds from the ATM Program, if any, to fund potential future acquisitions and for general trust purposes. The REIT does not currently anticipate using the ATM Program in the near future.

Distributions of the Units pursuant to the ATM Program, if any, will be made pursuant to the terms of an equity distribution agreement dated May 5, 2021 (the “Distribution Agreement”) between the REIT and CIBC Capital Markets, as agent (the “Agent”). The ATM Program is being established pursuant to a prospectus supplement dated May 5, 2021 (the “Prospectus Supplement”) to the REIT’s short form base shelf prospectus dated January 23, 2020, as amended on April 27, 2021 (the “Base Shelf Prospectus”). As the Units sold pursuant to the ATM Program will be issued and sold at prevailing market prices at the time of sale, prices may vary among purchasers during the period of distribution.

The ATM Program will terminate upon the earlier of: (i) the issuance and sale of all Units subject to the Distribution Agreement through the Agent on the terms and subject to the conditions of the Distribution Agreement; (ii) the receipt issued for the Base Shelf Prospectus ceasing to be effective in accordance with applicable securities laws; and (iii) termination of the Distribution Agreement in accordance with its terms.

Copies of the Distribution Agreement, the Prospectus Supplement and the Base Shelf Prospectus will be available on the REIT’s SEDAR profile at www.sedar.com. Alternatively, the Agent will send copies of the Distribution Agreement, the Prospectus Supplement and the Base Shelf Prospectus, upon request only, by contacting the Agent at CIBC World Markets Inc., 161 Bay Street, 7th Floor, P.O. Box 500, Toronto, Ontario, M5J 2S8.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

About the REIT

The REIT is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario. The REIT currently owns and operates a portfolio of 46 commercial properties consisting of approximately 4.8 million square feet in urban and select strategic secondary markets across Canada focusing on long term leases with government and credit rated tenants.

The REIT is focused on growing its portfolio principally through acquisitions across Canada and such other jurisdictions where opportunities exist. Additional information concerning the REIT is available at www.sedar.com or the REIT’s website at www.truenorthreit.com.

Non-IFRS measures

Certain terms used in this press release such as funds from operations (“FFO”), adjusted funds from operations (“AFFO”), net operating income (“NOI”), same property net operating income (“Same Property NOI”), indebtedness (“Indebtedness”), gross book value (“GBV”), Indebtedness to GBV ratio, net earnings before interest, tax, depreciation and amortization and fair value gain (loss) on financial instruments and investment properties (“Adjusted EBITDA”), interest coverage ratio, and adjusted cash provided by operating activities are not measures defined by International Financial Reporting Standards (“IFRS”) as prescribed by the International Accounting Standards Board (“IASB”), do not have standardized meanings prescribed by IFRS and should not be compared to or construed as alternatives to profit/loss, cash flow from operating activities or other measures of financial performance calculated in accordance with IFRS. FFO, AFFO, NOI, Same Property NOI, Indebtedness, GBV, Indebtedness to GBV ratio, Adjusted EBITDA, interest coverage ratio and adjusted cash provided by operating activities as computed by the REIT may not be comparable to similar measures presented by other issuers. The REIT uses these measures to better assess the REIT's underlying performance and provides these additional measures so that investors may do the same. Details on non-IFRS measures are set out in the REIT's Management's Discussion and Analysis for the three months ended March 31, 2021 (“MD&A”) and the Annual Information Form (“AIF”) are available on the REIT's profile at www.sedar.com.

Forward-looking Statements

Certain statements contained in this press release constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking statements are provided for the purposes of assisting the reader in understanding the REIT’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Forward-looking information may relate to future results, performance, achievements, events, prospects or opportunities for the REIT or the real estate industry and may include statements regarding the financial position, business strategy, budgets, projected costs, capital expenditures, financial results, the REIT's ATM Program and the intended use of proceeds from such program, taxes, plans and objectives of or involving the REIT. In some cases, forward-looking information can be identified by such terms as “may”, “might”, “will”, “could”, “should”, “would”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “seek”, “aim”, “estimate”, “target”, “goal”, “project”, “predict”, “forecast”, “potential”, “continue”, “likely”, or the negative thereof or other similar expressions suggesting future outcomes or events.

Forward-looking statements involve a number of risks and uncertainties, including statements regarding the outlook for the REIT's business and results of operations and the effect of the coronavirus (SARS- CoV-2) ("COVID-19") pandemic on the REIT's business and operations. Forward-looking statements involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond the REIT’s control, affect the operations, performance and results of the REIT and its business, and could cause actual results to differ materially from current expectations of estimated or anticipated events or results. These factors include, but are not limited to, risks and uncertainties related to the trust units of the REIT (“Units”), risks related to the REIT and its business, and any risks related to the uncertainties surrounding the duration and the direct and indirect impact of the COVID-19 pandemic on the business, operations and financial condition of the REIT and its tenants, as well as on consumer behavior and the economy in general, including the ability to enforce leases, perform capital expenditure work, increase rents, raise capital through the issuance of Units or other securities of the REIT and obtain mortgage financing on the REIT's properties. The foregoing is not an exhaustive list of factors that may affect the REIT's forward-looking statements. Other risks and uncertainties not presently known to the REIT could also cause actual results or events to differ materially from those expressed in its forward-looking statements. The reader is cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking statements as there can be no assurance actual results will be consistent with such forward-looking statements.

Information contained in forward-looking statements is based upon certain material assumptions applied in drawing a conclusion or making a forecast or projection, including management’s perception of historical trends, current conditions and expected future developments, as well as other considerations believed to be appropriate in the circumstances. There can be no assurance regarding: (a) the breadth of impact of COVID-19 on the REIT’s business, operations and performance, including the performance of its Units; (b) the REIT’s ability to mitigate any impacts related to COVID-19; (c) credit, market, operational, and liquidity risks generally; (d) Starlight Group Property Holdings Inc., or any of its affiliates (“Starlight”), continuing as asset manager of the REIT in accordance with its current asset management agreement; and (e) other risks inherent to the REIT’s business and/or factors beyond its control which could have a material adverse effect on the REIT.

The forward-looking statements made relate only to events or information as of the date on which the statements are made in this press release. Except as specifically required by applicable Canadian law, the REIT undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

For further information:

Daniel Drimmer

President and Chief Executive Officer

(416) 234-8444

or

Tracy Sherren

Chief Financial Officer

(416) 234-8444